Trump Joins Washington Establishment to Rescind Rule Banning Mandatory Credit Card Arbitration

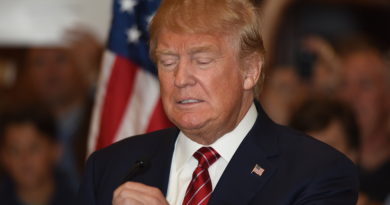

President Donald Trump and the Washington establishment, seemingly at constant loggerheads since the 2016 election, apparently can agree on selling out the American people. The Senate just passed a bill that will rescind the Consumer Financial Protection Bureau (CFPB) rule banning mandatory arbitration clauses found in the fine print of credit card agreements. Shortly thereafter, the White House issued a statement applauding the Senate for passage of the bill, leaving no doubt that President Trump will sign the bill into law without delay.

The statement issued by the Trump White House attempts to spin the measure as being in the interests of small business and local banks. The statement spuriously claims that “consumers would have fewer options for quickly and efficiently resolving financial disputes”. This is clearly false as arbitration clauses place limits on how consumers may seek redress any disputes that may arise with their credit card issuing bank. Prohibition of making arbitration mandatory to settle such disputes actually opens up the options available for redress by consumers.

The CFPB’s rule against mandatory arbitration clauses was easily one of the few things to truly serve the interests of every day Americans to come out of the Dodd-Frank financial reforms. Dodd-Frank was passed in the wake of the 2008 financial crisis and led to the creation of the CFPB. Failure by the Obama Administration and Obama’s Attorney General, Eric Holder, to hold any of the “too big to fail” banks accountable for the massive and widespread fraud that caused the 2008 financial crisis fueled animosity toward the Washington establishment.

In the 2016 U.S. presidential election, candidate Trump rode this wave of animosity to an upset victory against long-time Washington fixture, Hillary Rodham Clinton, in the 2016 U.S. Presidential Election. During the campaign, Trump railed against Clinton and the establishment for their cozy relationships with the big banks. The Trump White House’s position completely ignores not only the anger in the nation against the banking establishment that helped him elected, it also ignores the current climate of poor security of consumer information by the financial services sector highlighted by the recent Equifax debacle.

November 1, 2017 Update

White House relesed a statement that President Trump today signed into law:

H.J.Res. 111, which nullifies the Consumer Financial Protection Bureau’s rule prohibiting the use of a pre-dispute arbitration agreement to prevent a consumer from filing or participating in certain class action suits.

So much for drainin’ that swamp!

For more, see:

- White House Statement on Regarding Senate Passage of H.J. Res. 111

- President Donald J. Trump Signs H.J.Res. 111 into Law

- Senate Kills Rule On Class-Action Suits Against Financial Companies via NPR,

- Congress just killed a rule that would have made it easier for consumers to sue banks — here’s why people are so upset